Lawton Public School Foundation has some exciting news!

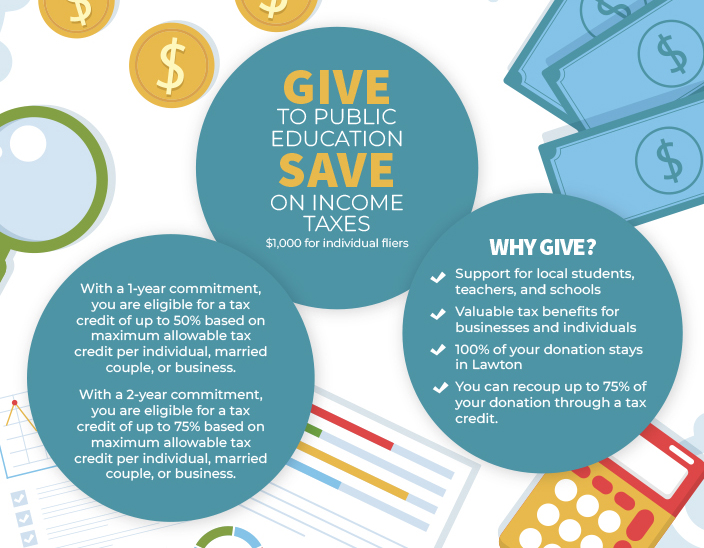

As of 2023, you can donate to the LPS Foundation to enrich education for our students and receive a tax credit with the Oklahoma Tax Commission!

LPS Foundation encourages you to partner with us in this new opportunity. We are asking businesses for a minimum gift of $5,000 and individuals or couples for a minimum gift of $2,000 to participate in this special opportunity. According to the Oklahoma guidelines, these donations will fund innovative and creative programs in Lawton Public Schools. This is a win for all!

The Oklahoma Equal Opportunity Education Scholarship Act allows Oklahoma taxpayers to donate to the Lawton Public School Foundation and receive a portion of their contribution back in state income tax credits.

The Oklahoma Legislature expanded the Equal Opportunity Scholarship Act to allow taxpayers to receive tax credits for certain donations earmarked for public education. By taking advantage of this new state law, you may receive up to 75% of the donation back in the form of a state income tax credit, substantially reducing your Oklahoma state income tax liability.

Oklahoma Tax Credit Limits

The Oklahoma Education Tax Credit program has annual limits on the state income tax credits the OTC will issue:

– $25 million in tax credits may be issued for public education statewide

– $200,000 cap for Lawton Public Schools

– $1,000 cap for an individual / single filing

– $2,000 cap for married filing jointly

– $100,000 cap for businesses

LPS Foundation Eligibility Requirements

– Donations must be a minimum of $5,000 for businesses (per guidelines set by LPS Foundation)

– Donations must be a minimum of $2,000 for individuals or married couples (per guidelines set by LPS Foundation)

– Donations must be postmarked by December 31, 2023

– Donors must complete the tax credit eligibility form

– Donors must submit their tax receipt with their tax filings

How to

Contribute

– Mail a check to Lawton Public School Foundation along with the completed Donation Form.

– LPS Foundation will send you a tax receipt for your records. Submit this tax receipt with your tax filings.

Tax Credit FAQs

*Donations given for sponsorship and/or advertising for an event do not qualify for this program

The information provided by the LPS Foundation is not intended to constitute tax or legal advice. All content herein is for informational purposes only. LPSF recommends you consult with your tax professional or financial advisor for tax advice based on your specific financial circumstances.